Urban Planning and Your Real Estate Investment

Creating Demand

One way that city planning can affect the value of your property is scarcity. In reality, the entire population of the United States could fit in the state of Texas with every household having one acre of land. Due to artificial scarcity created by zoning codes, however, land prices are extremely high in certain parts of the world. A square mile of residential land in Manhattan, for example, would cost about $16.5 billion. This artificial scarcity is created by regulatory limits on the height of density of buildings. As such, most of the property value that landowners enjoy is due to the fact that more residential living space cannot be created in that particular area. Therefore, if city planning involves lifting some of these regulations or otherwise making it possible for more residential living space to be created, the scarcity can be reduced resulting in a reduction in property value.

Infrastructure and City Amenities

City planning in terms of the development of new infrastructure also raises the value of the land that is nearby. This, in turn, helps to pay for additional improvements in the city, thereby creating a cyclical effect that can help to increase the value of your property.

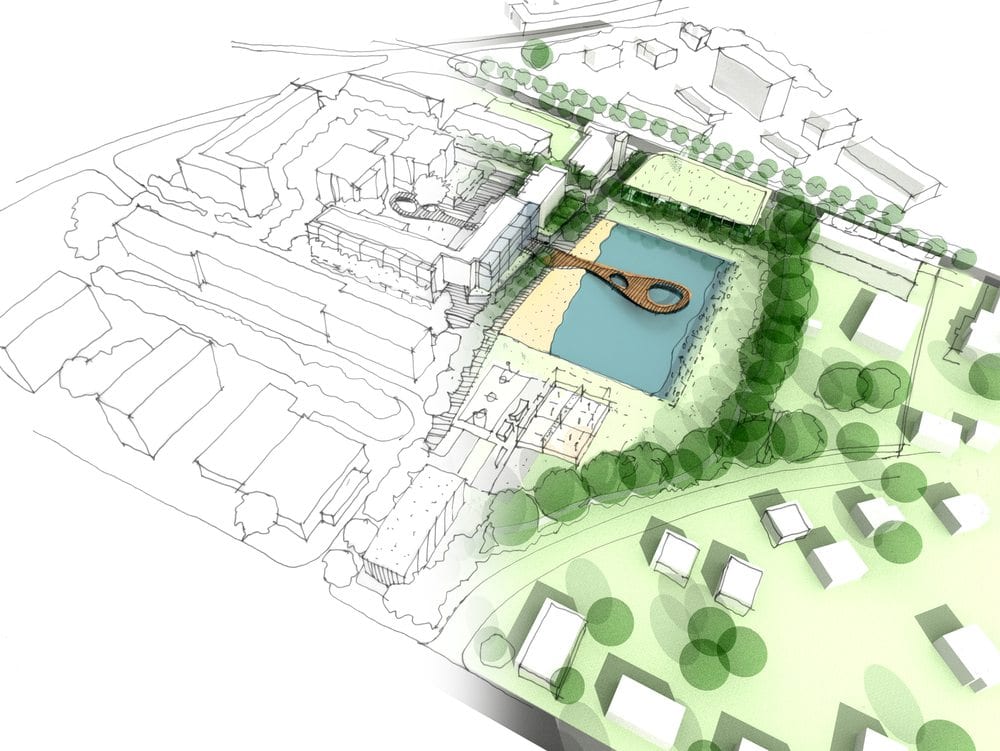

Adding city amenities such as parks can also have a positive effect on property values. In one study conducted by Frederick Law Olmsted, the value of property adjacent to Central Park was tracked in an effort to justify the $13 million it cost to create the park. The study found that the value of the property impacted by the park increased by $209 million over a 17-year period. Several studies over the last 20 years have shown a similar connection. In Atlanta, for example, a condominium located next to Centennial Olympic Park increased in value from $115 to $250 per square foot after the park was built. In Amherst, Massachusetts, cluster housing with dedicated open space appreciated in value by 22 percent in one year compared to a comparable conventional subdivision rate of 19.5 percent.

The bottom line is that city planning can have a significant impact on the value of your property. If artificial scarcity is lifted, the value can be reduced. Similarly if new infrastructure and amenities are created in the area, it can increase the value of your property. By keeping an eye on plans that the city is making, you can better identify which properties will be the best choice for investment.